Sawing machine and storage system supplier, KASTO, reports that turnover in the UK in 2012 will be 12 to 15 per cent higher than in the previous year. Located in Milton Keynes, the firm is a wholly owned subsidiary of the KASTO group, which has its headquarters in Achern, Germany.

Sawing machine and storage system supplier, KASTO, reports that turnover in the UK in 2012 will be 12 to 15 per cent higher than in the previous year. Located in Milton Keynes, the firm is a wholly owned subsidiary of the KASTO group, which has its headquarters in Achern, Germany.

The increase in the level of business is commendable, bearing in mind that 2011 itself was a record year for KASTO in the UK. To put in perspective how well its customers and British manufacturing as a whole appear to be coming out of recession, the company’s turnover is three times that of 2009.

In relation to the many facets of KASTO UK’s business over the past 12 months, managing director Ernst Wagner highlights three issues. In the first, he bemoans a chronic shortage of competent electrical / mechanical / hydraulic service engineers, which has had an adverse effect on this aspect of the business.

On a positive note, the second point he makes is that as a result of three years’ solid performance, a new sales engineer has been appointed with effect from January 2013. Nearly 30 years’ experience selling sawing machines plus knowledge of the steel stockholding industry ideally suit him to his new post.

Mr Wagner’s last topic was to point out that a new report published in November 2012 by business analysis firm, Plimsoll, which reviewed data from 78 saw manufacturers and suppliers, placed KASTO UK in the top rank (of five) in terms of business performance.

Storage systems are potential for growth

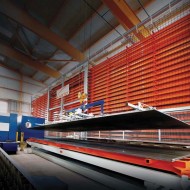

The automated storage system side of the company’s activities remained constant as a proportion of turnover, accounting for a quarter of capital equipment sales during the year. The systems have all gone to OEMs; none to stockholders or subcontract manufacturers. The latter sectors, however, are good prospects for increased business. Holding long stock and sheet efficiently, securely and with full traceability is an appealing alternative to having material in conventional racking or on the floor.

Despite constant sales of tower stores over the past couple of years, enquiries have increased dramatically this year, by a factor of eight. It indicates that British manufacturers and stockholders are becoming more aware of, and receptive to, the message that prompt delivery of material to saws and other production equipment is key to making them more productive. Indeed, towards the end of November 2012, a significant order for an automated system was secured, valued in excess of £1 million.

Although KASTO is best known for its wide range of bandsaws and circular saws, the storage system side of the business is the one earmarked by Mr Wagner for rapid growth in the years ahead. He believes it will ultimately double the company’s turnover, mirroring the expansion in automated storage systems already seen in consumer goods manufacture and distribution.

The reason is not only down to business efficiency, but also to the high cost of land and hence industrial space in the UK. Saving floor area with vertical storage solutions, which allow more productive use of a building, means that there is more space for additional machines or storage. The approach can postpone or avoid having to move premises as a company expands.

Carbide sawing maintains upward trend

Mr Wagner continues, “2012 was the first year during which we sold almost the full gamut of our different types of sawing machine, from top-end bandsaws through mid-range models to our workshop programme for jobbing applications.

“We also delivered circular saws for high volume cutting, including one of our WAC machines for use with tungsten carbide tipped (TCT) circular blades.”

Machines were taken by stockholders of steels and alloys, but a majority were destined for manufacturers and subcontractors. Over half of the bandsaws delivered are cutting exclusively with TCT bandsaw blades, while other machines are using them for part of the time and bimetal blades for the remainder.

The reason for a company choosing carbide tipped teeth centres on the need to lower cost per cut to remain competitive, which applies to both stockholding and manufacturing. TCT or ceramic circular blades can achieve six to 10 times faster cutting rates than high speed steel blades, but only on general steels up to 150 mm diameter.

Predictions for 2013

Mr Wagner foresees significant growth in automated storage system installations in the short term. Looking at the level and quality of current enquiries, this activity could easily reach 40 per cent of KASTO UK’s capital equipment sales turnover in 2013.

It is likely to be a more difficult year for sawing machine sales into the mild steel processing sector, he thinks, due to a slowdown in the automotive industry across Europe, which takes a sizeable amount of manufactured components from UK firms. At least the British automotive industry is doing relatively well, which may help to offset the challenges.

On the positive side, sawing of more ‘difficult’ materials including stainless steel is likely to remain buoyant. Such metals are used widely in manufacturing for power-related industries including turbines, oil and gas equipment, nuclear plants and renewables, as well as in aerospace and motorsport. All of these sectors and their supply chains are healthy at present. Many require fast delivery of parts and material with full traceability, largely precluding the use of manufacturers based in low-wage economies.

KASTO Ltd

Comments are closed.