It’s been an eventful summer so far for the UK industrial property market. Several high profile investment and occupational transactions completed in Q2 and with genuine speculative development now underway, industrial property has been making the news in the last few months.

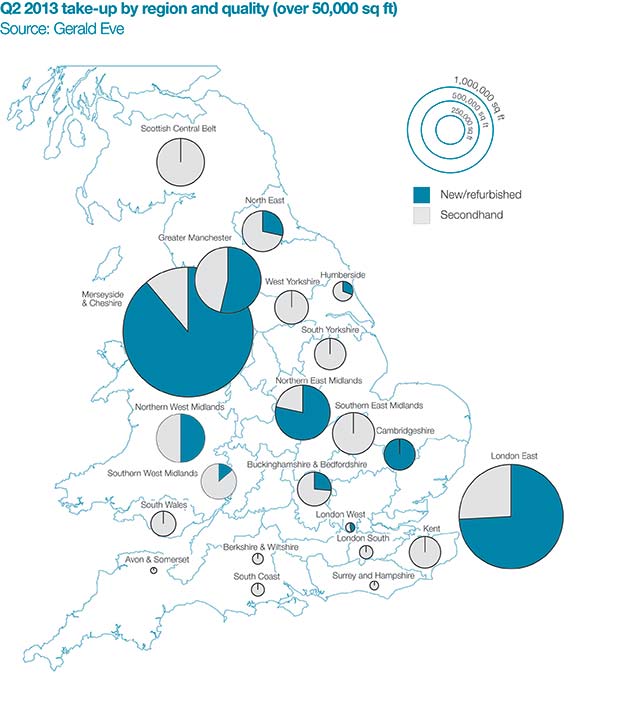

Take-up for the second quarter exceeded expectations, totalling 10.4 million sq ft, the largest volume of space taken since Q3 2011. Three transactions of over half a million sq ft completed during the quarter (together totalling over 2 million sq ft) which significantly boosted overall volumes. But even excluding these large deals, take-up was fairly robust across most geographies, with our regions in London, the North West and the West Midlands recording the greatest volumes. The largest deal of the quarter was the 900,000 sq ft pre-let by Marks & Spencer at PD Ports’ new tri-modal London Gateway logistics scheme. Marks & Spencer plan on using the rail infrastructure to link to the rail terminal at its Castle Donnington site, with construction expected to begin early in 2014.

As a 1,500 acre site with planning approval for 9.25 million sq ft of accommodation and potential floorplates of up to 1.29 million sq ft, the London Gateway scheme has strong dynamics to attract supply-starved tenants in the current market. We believe that if the rents are realistic, it will attract further large pre-lets from international companies or multichannel retailers before the port officially opens at the end of this year.

Other large occupational transactions agreed during Q2 include B&M Bargains completing a development purchase of a 500,000 sq ft warehouse within Liverpool International Business Park and Travis Perkins pre-letting 630,000 sq ft at the successful Omega scheme in Warrington. Since Brakes first committed to space on the Omega site in January this year, other occupiers such as DHL, Hermes Parcelnet and Asda have committed to the location.

Future opportunities will be concentrated in the south of the site as there are only two small plots left on the northern part of the scheme, each capable of accomodating a 50,000 sq ft building.

Royal Mail and Parcelforce have also continued to be acquisitive during Q2, accounting for 676,000 sq ft of take-up within six separate transactions. This takes the total let or purchased by these companies to nearly 850,000 sq ft so far in 2013. Royal Mail has made significant investment in its Parcelforce business’s real estate in response to the growth in online retailing and all of the recent deals have been expansionary in nature, despite Royal Mail pursuing a major consolidation of its operations across the UK in recent years.

Increase

Just as the volume of space transacted during Q2 improved by 25%, the average deal size has also increased and now stands at 135,268 sq ft – an 11% increase on Q1 and indicative of the increased number of large pre-lets and pre-sales agreed during the quarter. This is also in part reflective of the increase in activity seen from the logistics and retail sectors during Q2 (together accounting for 69% of total take-up) as these types of tenants usually have requirements for larger floorplates when compared to occupiers in the manufacturing sector.

The demand profile by tenant sector has changed significantly since this time last year. During Q2 2012, manufacturing accounted for half of all quarterly take-up (at the time, several automotive and food companies decided to acquire space). As depicted opposite, the demand profile for Q2 2013 looks distinctly different. Manufacturing, whilst still accounting for 1.5 million sq ft (or 14% of total take-up) has not been as important a driver of demand. It has been logistics companies (largely servicing retail contracts) and retailers which have dominated our statistics – together accounting for 69% of take-up.

Given the number and type of requirements in the market, we expect retailers and logistics companies to continue to dominate activity through 2013 and we are therefore expecting take-up to show an annual improvement of around 8-10% by the end of the year. Amazon have several very large requirements for space in the market and whilst they are yet to commit to their large distribution centres given the national lack of supply, they are in advanced negotiations on three short term commitments for distribution into London.

Retail and logistics companies have also been the key drivers of development activity in Q2. 1.3 million sq ft of space was completed during Q2 – the largest of which was Prologis’s 300,000 sq ft development for Network Rail in the West Midlands, although Gazeley also completed on its 265,000 sq ft manufacturing/warehousing facility for AG Barr in Milton Keynes.

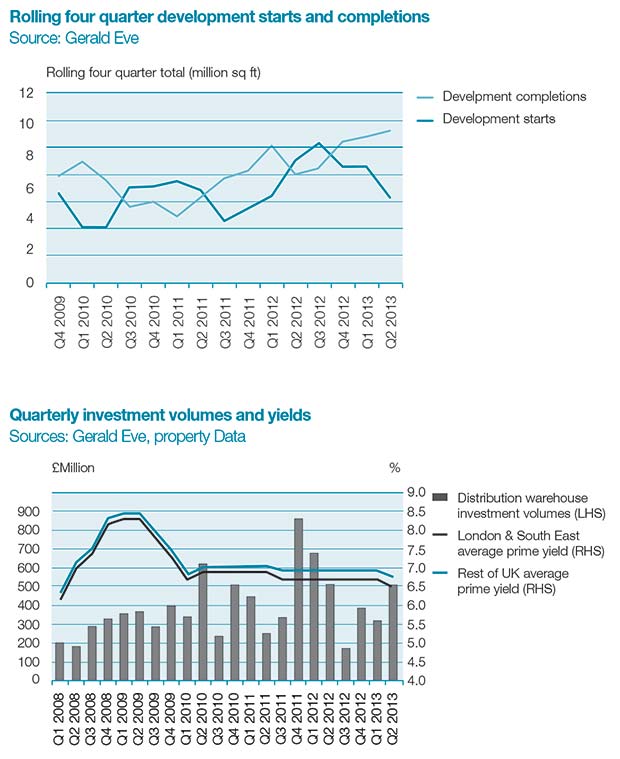

On a rolling four quarter basis, the volume of development starts has been on a downward trajectory for two quarters now, although volumes have by and large shown improvement since 2009. Negotiations on pre-lets remain protracted, especially so if development finance negotiations are part of the transaction. And whilst this is likely to continue to suppress the number of development starts, there are several schemes in the pipeline with firm occupier commitment which we expect to help increase the volume of development starts over the next few quarters.

There is also the prospect of an increase in speculative activity given that IM Properties have begun speculative development at Birch Coppice in Tamworth. This is the first meaningfully-sized, commercially-driven speculative development start since 2007. There is understood to be a signed-up occupier on the larger warehouse (168,900 sq ft), and given the supply shortage facing tenants, it is thought that it won’t be long before there is a committed occupier on the smaller unit of 165,495 sq ft.

The increase in development completions during Q2 has gone some way to supply the investment market, although the volume has not been sufficient to meet the high level of investor demand. The market is defined by strong investor interest and there has been intense bidding on the prime opportunities brought to the market during Q2. Investors are keen to allocate funds to the sector given its higher yield profile and its potential to offer the best risk-adjusted returns of all property sectors. Indeed, the volume of distribution warehouse investments traded during Q2 was up 59% on Q1, although this growth is largely attributable to Prologis/Norge Bank Investment Management’s £247.56 million purchase of 11 distribution assets. The limited supply of investment-grade stock is actually curtailing volumes, despite the serious interest in the sector.

Given the step-change in investor sentiment for prime logistics assets during the quarter, we have moved in prime yields across the board in Q2 by a national average of 20 basis points. This has reduced all regional averages and the yield profile in London and the South East is now at its lowest since Q1 2008. There is a weight of money targeting the sector and whilst we expect the volume of development completions to show improvement next year (and take-up is showing quarterly growth), which in turn will feed the investment market with much-needed stock; the supply/demand imbalance is unlikely to materially change this year.

This could redirect investor focus on good secondary properties with positive re-letting or development potential, although location will remain key, with properties in the Golden Triangle, London and the South East remaining most in demand. Strong income return and increased prospects for rental growth as a result of rallying occupier demand and very constrained supply (our UK availability rate reached an all-time low of 11.4% at the end of Q2) in certain locations certainly helps validate this investment strategy. Our outlook therefore is for further competition on the best space and the potential for further inward movement of prime yields before the year is out.

Comments are closed.