Over £1.03 billion of capital was invested in UK industrial and logistics property in the first half of this year, more than the total volume transacted in 2012, according to new research from global property advisor CBRE.

Overseas and domestic buyers have been attracted to the asset type due to its defensive investment qualities, underpinned by robust occupier demand in core UK locations. Industrial and logistics property has consistently outperformed the IPD benchmark, and the improved debt market and reallocation of portfolios away from gilts and equities has led to further focus on the asset class.

Overseas and domestic buyers have been attracted to the asset type due to its defensive investment qualities, underpinned by robust occupier demand in core UK locations. Industrial and logistics property has consistently outperformed the IPD benchmark, and the improved debt market and reallocation of portfolios away from gilts and equities has led to further focus on the asset class.

Overseas purchasers accounted for 37% of all capital invested, followed closely by UK institutions at 28%. Prior to the start of this year, buyers had predominantly focused on properties which provided either short or long dated stock, but in 2013 a lack of supply has caused a dramatic rise in parties seeking mid-term income (8-12 years unexpired terms).

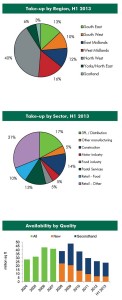

Regionally, the strategically located South East and East Midlands markets have together accounted for more than half of all purchases by value in H1 2013. This is due to their excellent transport links and access to the wider UK market.

Richard Moffitt, Head of UK Industrial and Logistics, CBRE said: “We have witnessed a resurgence in buyers eyeing quality UK industrial and logistics property this year, driven by compelling evidence of the sector’s performance relative to other asset classes. Occupier markets continue to thrive, and the resulting lack of prime stock has led to a surge in design and build activity in the best markets. The high levels of investment have led to an inward movement in prime yields, now at 5.5% for the best stock, and we expect this trend to continue as competition for prime assets grows.”

SPECULATIVE DEVELOPMENT RETURNS AS TAKE-UP VOLUMES RESTRICTED BY LOW LEVELS OF SUPPLY

Demand

• Take-up during the first quarter of 2013 was significantly down on recent years. However, since Easter there has been a resumption of activity, despite supply shortages

• A total of 7.05 million sq ft was taken during the first half of 2013.

• Larger deals are inevitably taking longer to conclude, as Design and Build solutions are now the only option available. As a result, D&B deals continued to account for a high proportion of occupier activity, comprising 71% of takeup on new buildings

• Prime rents in the majority of markets have remained stable, however in some locations there is upward pressure on prime units, with premiums for D&B.

Supply

• Supply levels continue to decline with a total of 23.9 million sq ft of logistics space is available and ready to occupy across the UK at the end of June. This is down 7% since over the end of 2012, and is 52% lower than at the supply peak in 2009.

Investment

• A total of £1.03bn of investment purchases of logistics properties were completed during the first half of 2013, with a marked surge in interest since April.

• Demand from investors has shifted to medium-term income, having previously been high polarised to long-dated, annuity style buys or short-dated opportunities. A lack of prime product, but a desire to outperform IPD and take advantages of the sectors stronger income return have been some of the reasons behind the competitive market that has developed in recent months.

• Demand from investors has shifted to medium-term income, having previously been high polarised to long-dated, annuity style buys or short-dated opportunities. A lack of prime product, but a desire to outperform IPD and take advantages of the sectors stronger income return have been some of the reasons behind the competitive market that has developed in recent months.

UK OCCUPIER MARKET OVERVIEW

The start of 2013 saw much lower levels of take-up across the UK logistics market, despite requirements for warehouse space holding up. The first quarter in particular saw fewer deals sign, a reflection of the severe shortages of ready to occupy units in the UK’s core logistics markets.

Nevertheless, since Easter, we have seen activity levels pick up once again, with 7.05 million sq ft of logistics take-up, in units of 100,000 sq ft and above. As in 2012, pre-let design and build (D&B) transactions have been the dominant subgroup within the sector during the first half of 2013. Such deals have accounted for 71% of all new space acquired by occupiers and 44% across all quality types, in line with 2012. The high proportion of D&B deals also helps explains the slower start to this year, as these transactions take significantly longer to conclude than negotiations on existing buildings.

Whilst retailers have once again formed the largest share from any group of occupiers, with acquisitions by John Lewis, Aldi, B&M Bargains and Clipper Logistics (on behalf of SuperGroup), there has also been activity from a wider range of occupiers. Two deals by companies supplying the construction sector (Travis Perkins and Wolseley) have resulted in the construction sector accounting for 14% of take-up. Whilst taking smaller units on average, businesses in the postal and parcel delivery sector have also been active so for this year, with take-up from Hermes, Parcelforce, Royal Mail and DPD/Geopost so far this year.

Looking ahead, the increasingly positive results of business surveys provides encouraging signs that some strength may be returning to the UK economy. In addition a number of third party logistics providers are reporting increased activity in their own markets. In addition, in recent months, there have been improvements in recent months in both the number registrations of commercial and freight vehicles have as well as retail sales.

Availability levels of existing space have further declined during the first half of 2013 to 23.9 million sq ft, down 7% since the end of 2012, and 52% below the 2009 supply peak. All quality types have been declining during the year to date, with secondhand space eroding at a slight faster pace of 9%.

Availability levels of existing space have further declined during the first half of 2013 to 23.9 million sq ft, down 7% since the end of 2012, and 52% below the 2009 supply peak. All quality types have been declining during the year to date, with secondhand space eroding at a slight faster pace of 9%.

With existing supply exceptionally scarce in some core markets, we are beginning to see some evidence of upward pressure on rents. This is by no means widespread as it appears to be isolated to those locations experiencing the highest levels of demand, for example around London.

UK INVESTMENT MARKET OVERVIEW

The investment market for logistic warehouses has substantially improved during the first half of 2013, with a significant increase in purchasing volumes. Activity levels were held back in 2012, so the shift in the market over recent months marks an important turnaround. Already volumes are ahead of the full year 2012 total, with £1.03bn transacted over the last six months.

In recent years demand has been polarised with opportunistic investors targeting short term income with deliverable asset management opportunities and conversely UK Institutions have been targeting longer let or annuity grade investments.

In Q2 2013 we have seen increased interest from a host of purchasers for mid-term income (8-12 year unexpired terms) investments. Best in class assets, by virtue of specification and location are highly contested by a number of UK institutions and overseas Investors. The features of these transactions remains firmly rooted by the sound market fundamentals that have guided purchasing decisions for longer or shorter dated stock i.e. prime logistics locations, such as Greater London, M1 Corridor or Golden Triangle; modern, well specified buildings let to robust covenants. Any exposure to capital expenditure and income void on reversion continues to place outward pressure on yields for more secondary dated stock.

The absence of stock coupled with an improved debt market and redistribution of money away from Gilts and equities has led to a seismic shift in requirements for logistics given the defensive qualities associated with these assets. Outperformance of the IPD benchmark is of particular focus. Further, the economic outlook has strengthened during the course of the year thereby providing further support to occupational demand and compounding the current supply/demand imbalance that we have experienced since 2011. Further deals have signed during July including the Smyths Toys unit in Stoke and Big Blue in Birmingham.

This geographical preference is evident in analysis of transactions in H1. Two regions, the South East and East Midlands, have together accounted for more than half of purchases by value during the first six months of the year. Similarly, the mix of purchases in the first half is dominated by two groups: Overseas Investors account for a 37% share and UK Institutions 28%. Purchases from this group have been boosted by the acquisition of a portfolio of eleven LondonMetric properties. Project Piccolo was acquired by a joint venture between ProLogis and Norges Bank in June 2013. This portfolio sold for £247.5m.

This geographical preference is evident in analysis of transactions in H1. Two regions, the South East and East Midlands, have together accounted for more than half of purchases by value during the first six months of the year. Similarly, the mix of purchases in the first half is dominated by two groups: Overseas Investors account for a 37% share and UK Institutions 28%. Purchases from this group have been boosted by the acquisition of a portfolio of eleven LondonMetric properties. Project Piccolo was acquired by a joint venture between ProLogis and Norges Bank in June 2013. This portfolio sold for £247.5m.

With the resurgence in money entering the sector in 2013, at mid-year, we have begun to see inward movement in prime yields. As a result yields have moved in by around 25 basis point this year for prime logistics investment, to stand at 6.25% NIY at the start of July. However, we have also seen yield compression of a comparable magnitude within the wider industrial sector, with yields of 6.5% NIY for regional prime industrial estates and 8.25% NIY for good secondary assets.

LaSalle Investment Management

Tel: 0207 852 4000

Comments are closed.