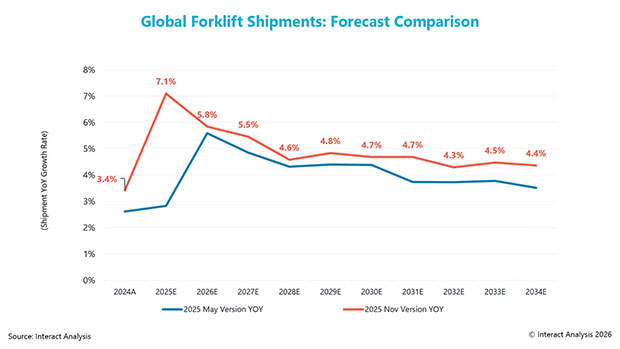

A “significantly more optimistic outlook” is forecast for the global forklift market from 2026 onwards, according to Interact Analysis. Its latest report sees the company revise its growth forecast for the forklift market upwards, as both the short-term trajectory and the long-term potential improve. The market intelligence specialist predicts a strong year-on-year growth rate of 5% between 2024 and 2034. Market growth rose from 3.4% in 2024 to reach 7.1% year-on-year in 2025 and Interact Analysis states its revised forecast ‘shows a consistently higher growth path through 2034, indicating sustained structural improvement rather than just a short-term bubble.’

China and India lead surge in global forklift orders

The global forklift market is expected to exceed 3.6 million units in annual orders by 2034, an increase of 400,000 from earlier predictions. Almost 80% of this growth is driven by Chinese and Indian markets, which are forecast to be at the forefront of global demand for material handling equipment over the next decade. China accounts for over 70% of the anticipated growth, with forecasts showing a widening contribution over time, particularly between 2030 and 2034.

Increasingly optimistic investment plans among end-customers

There are growing signs of optimism in the market, with 50% of end-customers anticipating increasing their investment in material handling equipment by more than 10% in 2026. Interact Analysis believes this enthusiasm for automation in manufacturing and logistics is driven by factors including rising labour costs and the increasing maturity of material handling solutions. However, many automation equipment manufacturers maintain a more cautious outlook due to challenges such as macroeconomic volatility, geopolitical uncertainty, global supply chain disruptions, and shortages of key components.

Maya Xiao, Interact Analysis APAC Research Manager, says, “Firstly, rising demand for automation in manufacturing and logistics is fuelling substantial investment in advanced material handling solutions. Secondly, the accelerated dual shift toward electrification and automation is boosting value and speeding up the replacement of outdated fleets. Finally, strong emerging market demand in regions like Southeast Asia, the Middle East, and Africa is adding further growth momentum.

“Last, but not least, an ageing population, rising labour costs, and difficulties in recruiting/retaining staff have become acute problems globally and a key strategy will be to use automation to make up for the shortages of human labor. This will be a long-term driver of the forklift industry. The convergence of supply chain reorganisation, technological transformation, and global infrastructure development creates a favourable environment for the next decade, with the upgraded 5% year-on-year forecast reflecting this sustained positive shift.”

Comments are closed.