• Take-up rises 30% to almost 10 million sq ft during Q1

• Pre-lets and pre-sales account for almost 40% of take-up

• A number of secondhand buildings are returned to the market, but supply remains short

• 1.2 million sq ft of speculative development under construction

• Further prime yield compression in the investment market and investors accept greater levels of risk

Every performance indicator in all parts of the market, from take-up to development through to investment, has been positive during the first three months of 2014. Despite the market’s limitations, which principally revolve around the shortage of available built stock, industrial property is enjoying a period of resurgence. Take-up for Q1 2014, for instance, was a robust 9.8 million sq ft, which marked a 30% rise on Q4 2013 and an 11% rise on the long term average quarterly take-up since 2007.

Every performance indicator in all parts of the market, from take-up to development through to investment, has been positive during the first three months of 2014. Despite the market’s limitations, which principally revolve around the shortage of available built stock, industrial property is enjoying a period of resurgence. Take-up for Q1 2014, for instance, was a robust 9.8 million sq ft, which marked a 30% rise on Q4 2013 and an 11% rise on the long term average quarterly take-up since 2007.

OCCUPATIONAL MARKET

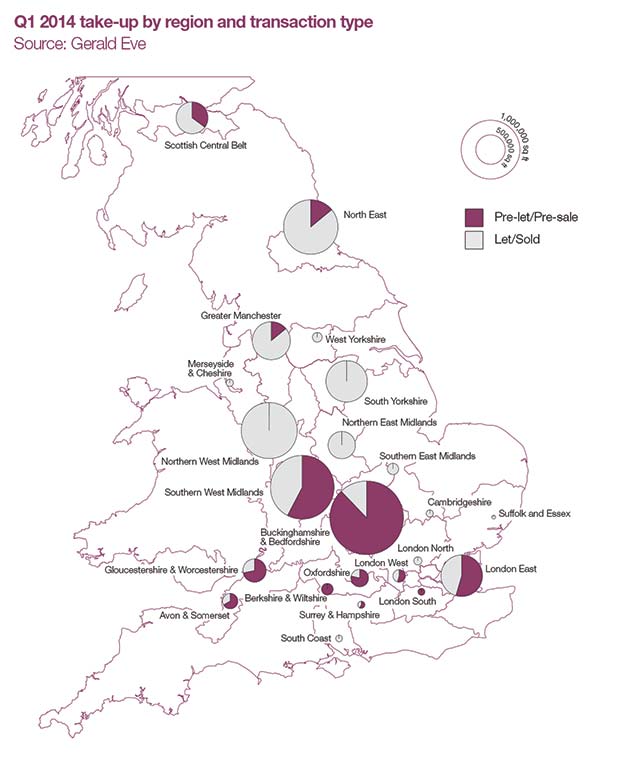

As depicted in the map opposite, take-up was strongest in the West Midlands, with over 2 million sq ft transacted during Q1, but demand was also strong in the south east of the country as food retailers such as Waitrose and Asda committed to large amounts of space. Waitrose pre-let 940,000 sq ft at Magna Park in Milton Keynes, a development which will act as its first national distribution centre and Asda took space in Belvedere and Heston both of which are to be used as dark stores to service the online market. Whilst falling into next quarter’s figures, LondonMetric also looks set to develop a million sq ft distribution centre for Primark in Islip, near Thrapston.

If agreed, this would be the largest pre-let since the development of Amazon’s 1.1 million sq ft shed in Dunfermline in 2011.

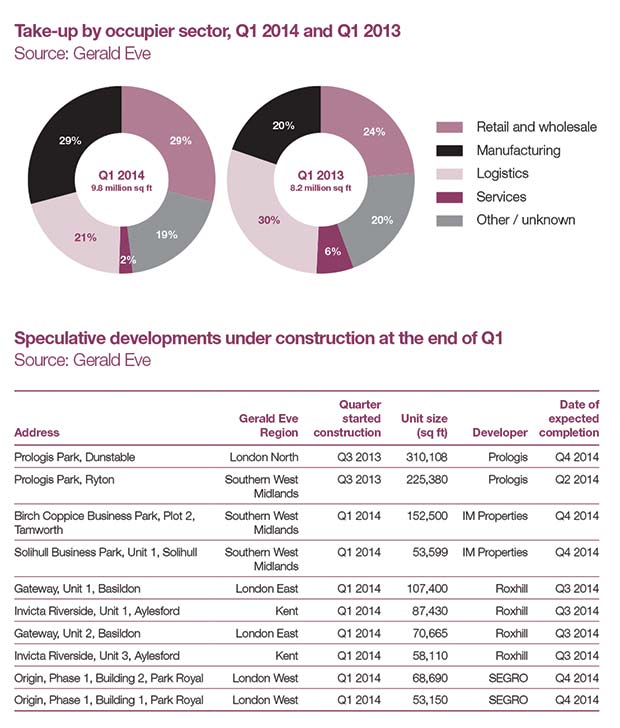

Retailers, therefore, continue to drive the top of the market and commit to the large pre-lets. The sector accounted for around 30% of total take-up in Q1, which is 5% more than it accounted for in Q1 2013. The importance of the sector is likely to continue through 2014 too given companies such as Lidl intend to acquire more regional distribution centres to support expansion plans. However, the manufacturing sector also accounted for around 30% of take-up in Q1, which is a 9% increase on its share in Q1 2013. The growth in the automotive export market and the knock-on effect this has had on companies in the supply chain has helped improve manufacturing demand, as companies such as DAU Draexlmaier Automotive and Stapletons Tyres committed to space. Ducab UK, a cable manufacturer also sub-let a 530,000 sq ft secondhand building in Chester-le-Street from Cable Realisations in the quarter.

Logistics companies accounted for only 21% of the total floorspace occupied in Q1, marking a significant reduction on the same period in 2013. There were some noteworthy deals concluded in the sector in Q1 however. Great Bear Distribution leased the 412,519 sq ft LPP: Sheffield building, Europa Worldwide Logistics pre-leased 262,600 sq ft at Littlebrook and UK Mail relocated from Birmingham and pre-purchased 231,000 sq ft at Prologis Park Ryton.

The smaller deals concluded during the quarter were in established logistics locations close to major urban conurbations, as companies aimed to position themselves to capitalise on the growing home delivery market.

Whatever the type of occupier looking for space, a defining feature of the market remains the shortage of available buildings from which to choose from. This remains the case despite the overall volume of availability increasing slightly in Q1 following the release back to the market of large buildings such as the million sq ft ex-Tesco ‘Bigfoot’ shed in Daventry, and, the completion of a handful of refurbishments. This slight increase (the overall availability rate rose marginally to 10% from 9.8% at the end of Q1) is more of a technicality and supply levels in reality remain at very low levels. It is perhaps for this reason that we have seen an increase in the number of sub-leases and lease assignments being agreed during Q1 (together totalling over 800,000 sq ft), as occupiers and landlords of in-demand buildings aim to plug the supply gap and capitalise on a supply-starved market.

DEVELOPMENT MARKET

DEVELOPMENT MARKET

Broadly speaking though, occupiers are reacting to the supply shortage by pre-leasing space. Pre-lets and pre-sales accounted for almost 40% of total take-up in Q1 and the development market is enjoying a commensurate increase in activity. However, several developers have also started speculative schemes in Q1, significantly increasing the number of such schemes under construction. As depicted in the table, there is around 1.2 million sq ft of space currently being developed speculatively, largely in and around London and in the West Midlands, all of which is expected to be completed before the end of the year.

All in all, 25 buildings started construction during Q1, the largest number of schemes getting underway in one quarter since Q4 2007. Eight of these schemes were started speculatively. Rolling four-quarter totals are back to the levels last since at the end of 2008, hopefully marking the end of the development market slump witnessed during the recession. With availability rates running at historic lows and demand for industrial space showing resurgence, not to mention an investment market with a voracious appetite for industrial, and the conditions are certainly conducive to further investment in the development market.

The 2014 Budget made reference to how the Government will consult on introducing greater flexibilities for change to residential use from warehouse and light industry, as part of its wider review of the General Permitted Development Order. Whilst it is still in early stages, this could entail an increase in the number of extensions undertaken by occupiers and make schemes with future development potential of more interest to occupiers, but it could also place added upward pressure on land prices, which are already rising in response to increased demand for land from developers. It will also place further pressure on the supply of industrial land, particularly in locations close to major urban conurbations.

INVESTMENT MARKET

Capital values continue to rise as investor appetite for industrial remains strong for another quarter. Prime yields on UK industrial have moved in by an average 75 basis points on a national basis and almost 90 basis points in London and the Midlands since Q1 2013. The industrial property investment market continues to be defined by a growing weight of money targeting the sector and a lack of suitable stock for investment. Fund allocations for industrial have been increasing, as have the number of dedicated funds targeting the sector. Even those investors who own stock which is well suited to current investor appetite are reluctant to sell given the desire to be positive net investors in the sector.

The ‘prime’ well-let, well-located buildings that do come on the market are therefore being fiercely fought over, but on more than one occasion during the quarter, the top end of the market has been driven by one or two very aggressive bidders. It has been these bidders, whose investment criteria or corporate structures, some of which are dedicated REITs, have allowed them to ultimately justify lower yields. The investors who are unwilling to go to the levels being achieved by the more aggressive bidders are now firmly looking up the risk curve. There has been a marked improvement in attitudes towards risk and more investors are now considering higher-yielding assets, typically with shorter income or weaker covenant strength, but also in non-standard locations. We could also see a growing speculative funding market for the best locations, given the improvement in demand and shortage of supply, or, perhaps more refinancing of extensions as we have seen with Lloyds on Matalan’s Galaxy warehouse in Knowsley.

This interest has driven further prime yield compression and we have seen all forms of investors interested in all income lengths during Q1. According to IPD, Industrial total returns have been steadily running above All Property total returns for a few years now, driven lately by the increasingly positive yield impact and growth in rents. Whilst industrial total returns have dipped slightly at the start of 2014, they remain above 5% on a rolling three-month basis and continue to outperform the All Property total return figure by a comfortable margin.

Our outlook for 2014 remains the same and we expect the improving occupational market to continue to feed through into the investment market. As more buildings are developed, either speculatively or on a design-and-build basis, this will provide the market with more prime stock on which to trade, but it is unlikely to be sufficient to match demand. We expect secondary to ultimately outperform prime over the medium term because as the appetite for risk continues to rise, the yield spread between secondary and prime will fall, which in turn will generate superior secondary yield impact and positively impact total returns.

Comments are closed.